Through Resolution 2162 of 2020, the Ministry of Finance established: (i) new requirements, (ii) the amounts that will be paid as of September, and (iii) the procedures for implementing the Formal Employment Support Program (PAEF). Below we include the main changes.

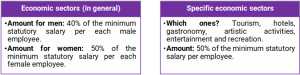

- Amount

*The aid provided for specific sectors cannot be accumulated with the one provided for female employees.

- How to determine the number of employees?

The number of employees shall be those reported in the Integrated Social Security Contribution Form (PILA) of the period immediately prior to the application month. These shall correspond at least with 50% of the ones reported in the PILA of February 2020.

*The employees’ number shall not be greater than the one reported in the PILA of February 2020.

** PAEF will apply to employees for whom the full month’s contribution has been paid and the novelty of temporary suspension or unpaid leave in the PILA has not been applied to them. Furthermore, the employees shall not have been taken into account for the PAEF calculation of another beneficiary.

- Beneficiaries

- Legal entities.

- Natural persons.

- Temporary unions.

- Autonomous equities.

- Associated work cooperatives.

- Who will not be able to apply?

Natural persons who meet any of the following conditions: (i) have fewer than three (3) employees reported in the PILA of February 2020; or (ii) are politically exposed persons or family members of such persons.

- Special restrictions for consortiums or temporary unions

- Consortiums and temporary unions may not apply for PAEF with the employees that have already been considered during the application of the natural or legal persons who integrate them.

- Similarly, natural or legal persons forming consortium and temporary unions may not apply for PAEF with the employees who have been taken into account for the consortium or temporary union’s application.

- PAEF application

To apply, the potential beneficiary must submit the following documents before a financial entity:

- Application form signed by (i) the employer (in the case of a natural person); or (ii) the legal representative

- Certification of compliance with requirements in which it is accredited: (i) an income decrease of 20% or more; and (ii) that employees’ salary of the previous month was paid.

* Additionally, in case there are labor debts for the months of August, September and/or October, it must be accredited that these will be paid within 5 working days following the receipt of the resources.

** For applications from September onwards, only those PILAs paid by the day of the maximum application period of each phase will be considered.

- Where to apply?

The process is carried out through the financial institutions. These latter may provide an application mechanism virtually.

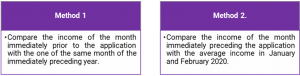

- How to calculate income decrease?

One of the two methods listed below may be used to calculate income decrease:

*PAEF is an income for the beneficiaries, however, it should not be considered for the purpose of calculating income decrease.

- September, October, and November applications

The Ministry of Finance set a new deadline from November 19 to 26 for applications corresponding to the months of September, October, and November.

- When are the application results known?

The results will be known from December 10th, for the subsidies corresponding to September’s applications.

- Calendar and application deadlines

The schedule and other application deadlines will be determined in the ” Operational Manual” that will be issued by the Ministry of Finance.

Download here.